A detailed analysis of the top six community enterprise platforms to determine which platform is best for which use cases.

A detailed analysis of the top six community enterprise platforms to determine which platform is best for which use cases.

How can you drive growth if you have an existing community program? Discover a process to make it work for oyu.

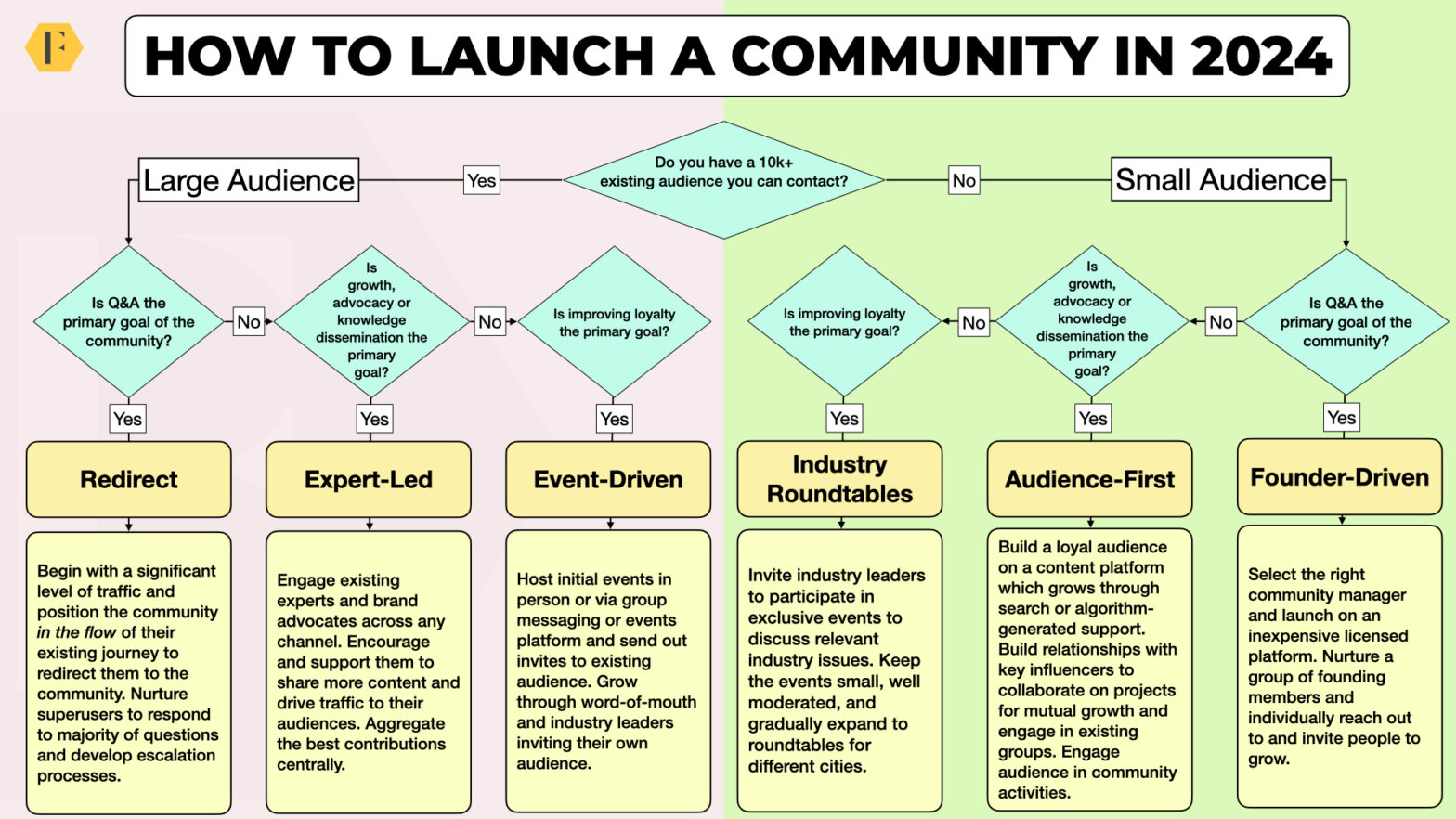

The approach you take to launch a community in the 2020s depends on two things; the size of the audience and the type of community you’re trying to launch.

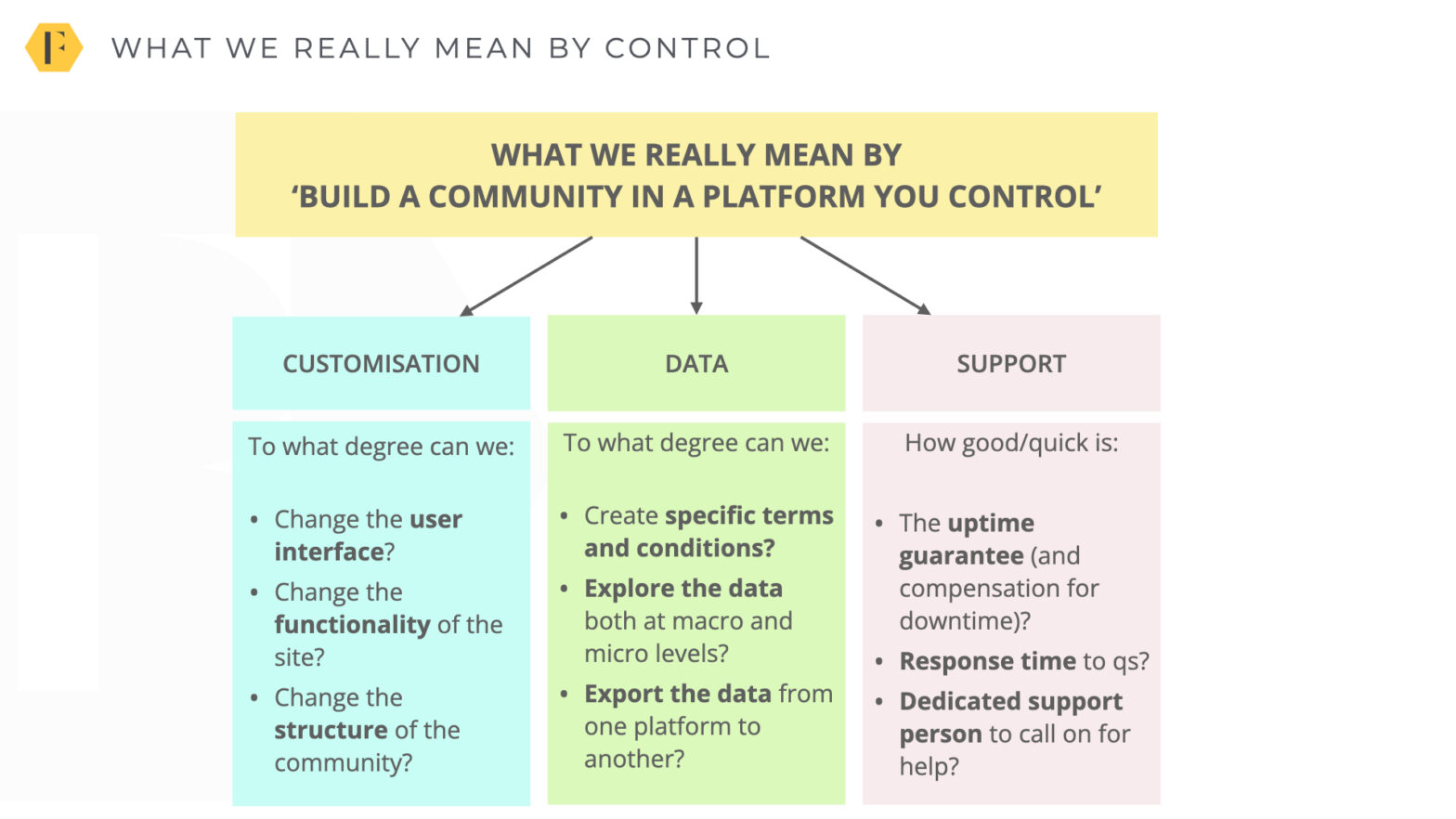

The idea that you should host your community on a ‘platform you control’ is a couple of decades old now. But the reality is there’s no such thing. Here’s a better way of thinking about it.

This year will be different from any past year of community building. Long-running trends have finally caught up with us. It’s time to adjust and adapt.

Stop comparing community members to non-members. There are much better ways to prove the value of your community. Here are two I’d recommend.

There are plenty of challenges you could tackle related to your enterprise community. Here are five I think are worth making a priority this year.

The way most people measure events is fundamentally flawed. Here’s a better approach which highlights what would have happened if you never held the event.

Make sure you get the critical decisions right and ensure everyone is on the same page about your community. This slide deck will show you how to make the right decisions for your community.